Klarna and Zip are two similar buy now, pay later apps with options to pay in-store and online. Which is more beneficial? This is the Klarna vs. Zip battle covering everything about the two.

Note: Both apps have interest-fee and interest-based services. The article solely covers interest-free services.

Takeaway

- Zip doesn’t do a credit check, and Klarna does a soft check.

- Both work in-store and online.

- Zip gives 30 days to repay, and Klarna charges 25% every fortnight.

- Overall, Zip is more beneficial.

Signing up

Signing up on both requires the same type of information. Both apps ask for your email, full name, and date of birth.

In some instances, you might be asked for identity proof. You are also asked for a repayment credit card.

Credit check

Klarna does not do a credit check when you sign up. However, while using the app, you are charged a 25% payment to ensure you have enough balance.

This is not the case with Klarna Financing, where you will pay interest, and your history might be reported to the authorities.

Zip Pay also does not do any credit checks. As long as the payments are made on time, you can keep using the service.

Availability

Klarna is available in multiple countries, including the US, UK, Australia, New Zealand, and some parts of Europe.

Its service is region-dependent. For example, in the US, it supports more significant purchases and gives up to 12 months of repayment plans with interest. In Australia, the option is not offered.

Zip Pay is available in Australia, New Zealand, the US, and Canada. The company has closed its services in the UK.

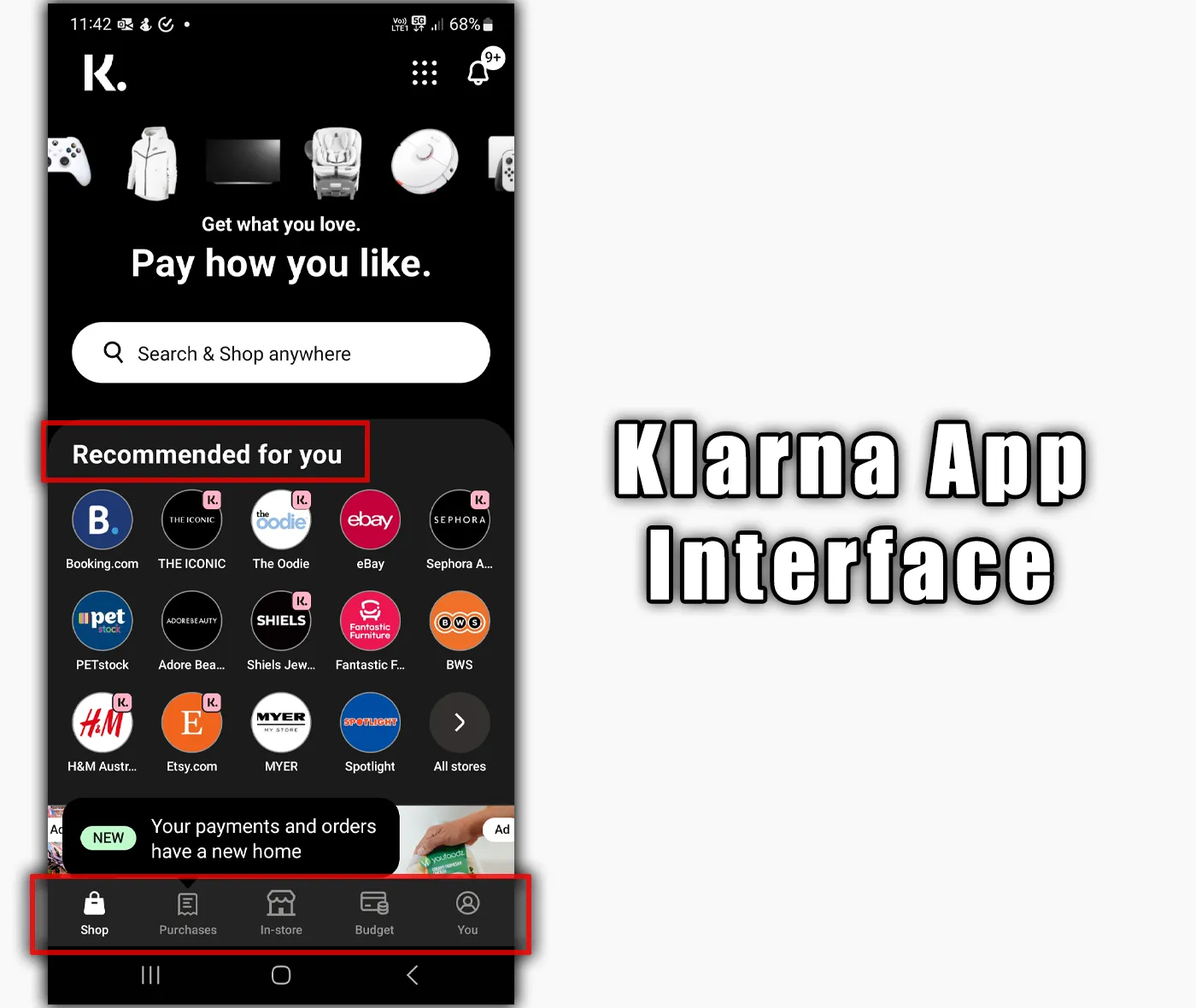

Supported stores

This is one of the similar rounds of Klarna vs. Zip. The best thing is that both apps work independently of the store.

If a store supports contactless card payments, you can use those. However, some store types are not allowed.

How do both work

In-store

Both let you create a Visa digital card to add to your payment app (Apple Pay or Google Wallet). The card can be used on contactless payment terminals.

With Klarna, you must open the app and put in the amount to spend to activate the card. The Zip Pay card is always active, so there is no need to open the app before paying.

Online

Using both online also involves generating a card. With Klarna, you must browse the retailer’s website in the app. On the checkout page, a button titled “Pay with Klarna” will be visible.

Tapping that button creates a digital card with all the required details. Payment can be made with that card. To learn to use Klarna, please read my step-by-step guide.

Zip Pay lets you generate a card in the app. The card can then be used on the website. Many retailers also support Zip Pay at checkout to sign in with your account and pay without the card.

Klarna vs. Zip: Limits

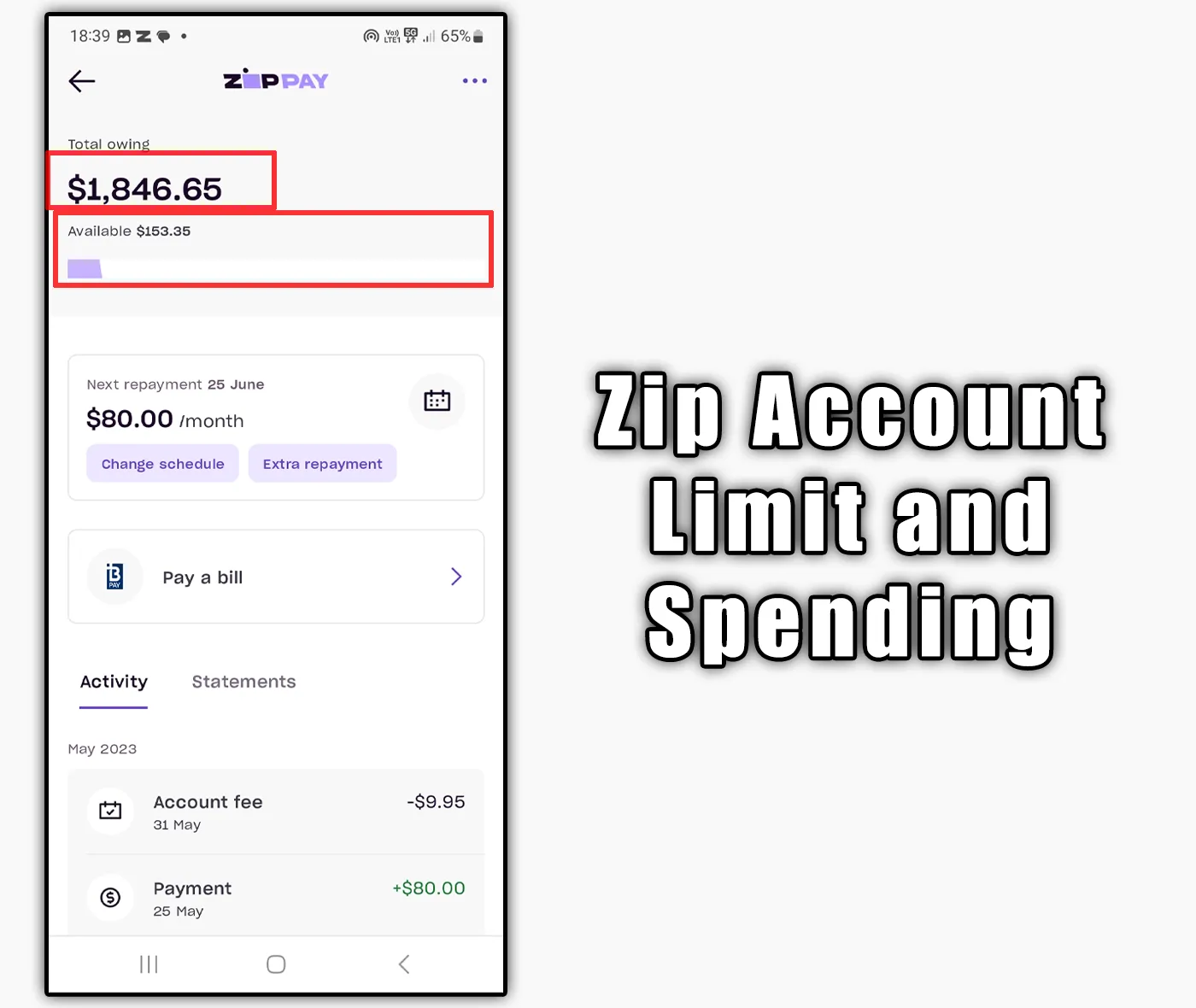

Both are a bit protective when it comes to limits. Klarna only gives a few hundred bucks in the beginning.

The problem with Klarna is that it does not show your actual limit. It has the term “Spending power,” which is still under development. So, it’s mostly a pay-and-pray thing.

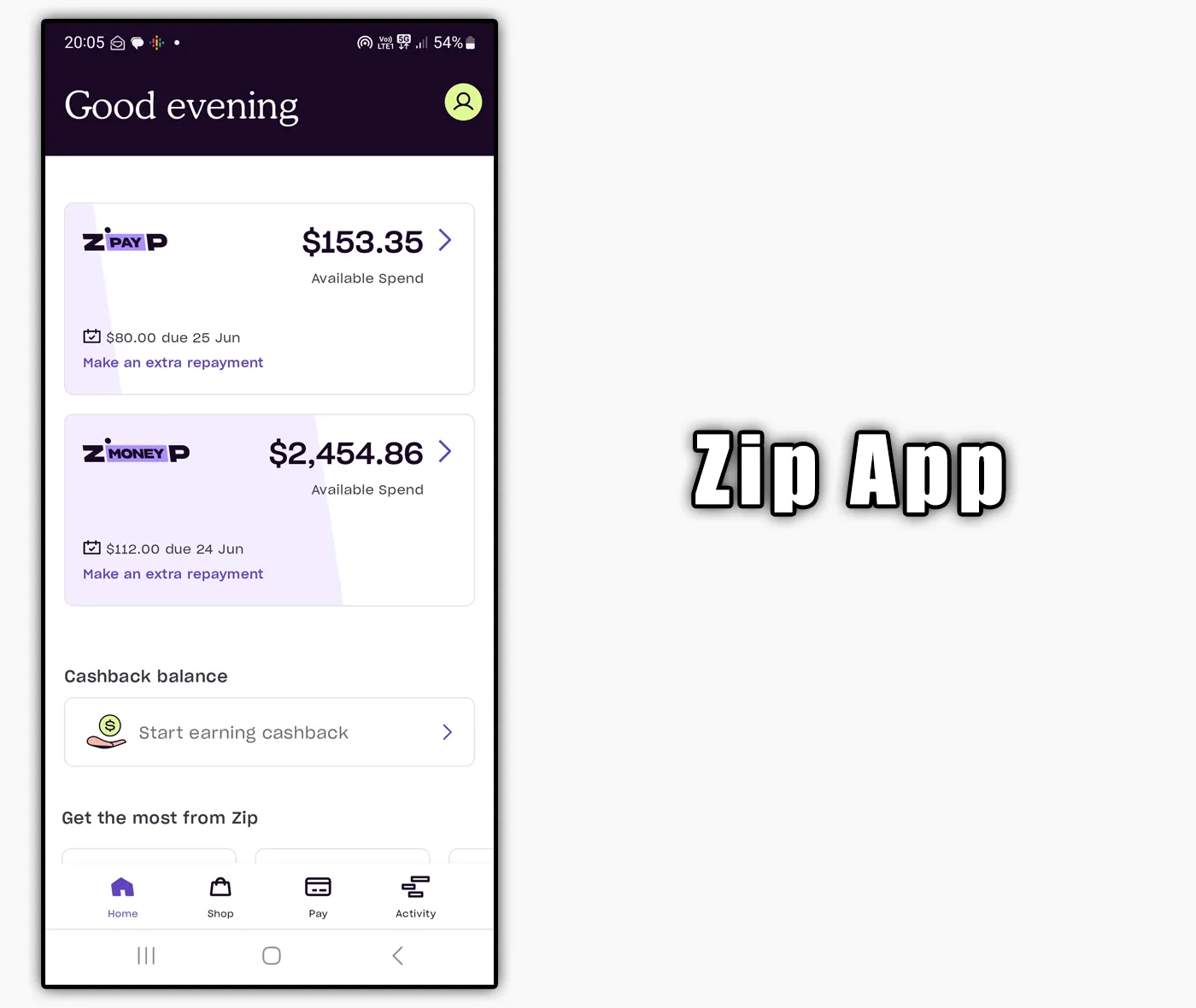

Zip Pay also gives about $300 initially, but they increase your limit quickly. You can score up to a $2,000 limit by using the service.

Repayments

As mentioned, Klarna charges the first 25% before generating the card. The rest are every fortnight, giving users 6 weeks in total.

Zip Pay is one of the apps with no down payment, meaning you don’t have to pay anything while shopping.

It gives you a month to pay. If the payment is not cleared by then, you are charged an $8 (which could be different in your region) monthly fee.

The app is flexible as they let you choose the repayment frequency, date, and amount.

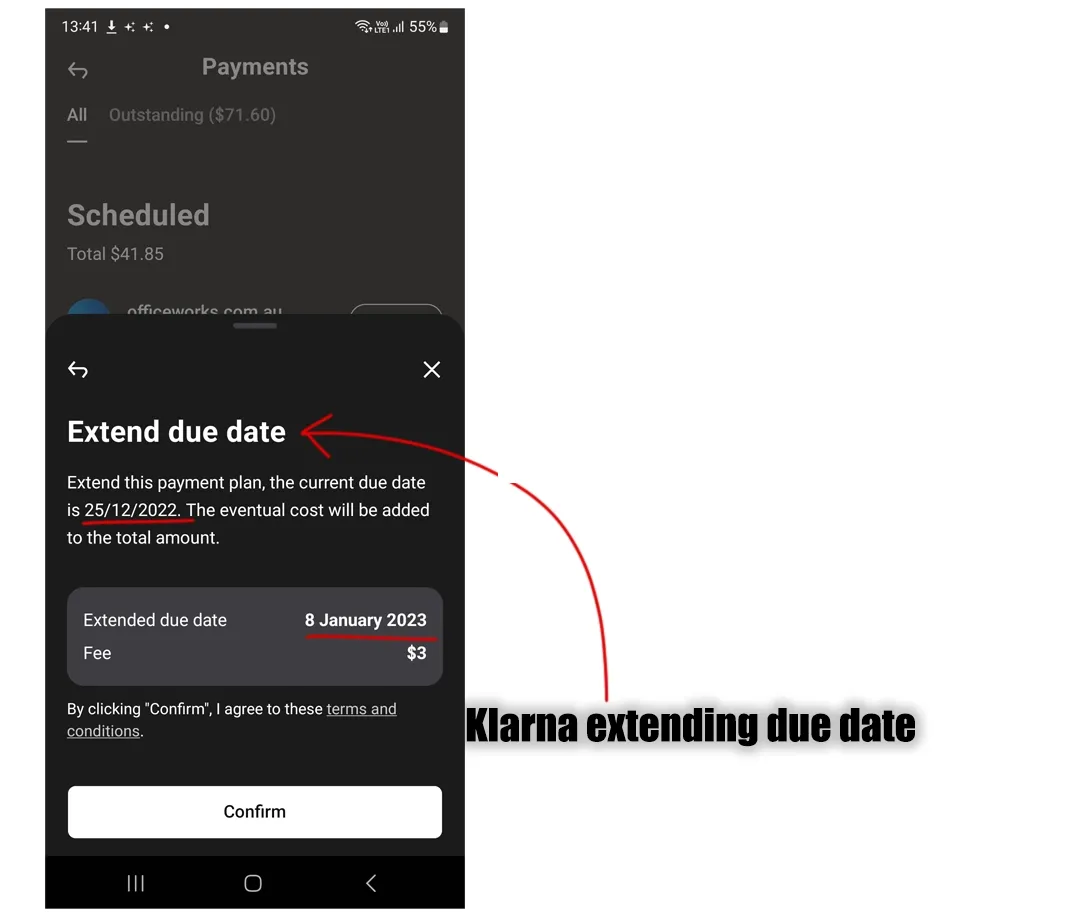

Late fees and payment extension

One of the great things about Klarna is its payment extension. Users can get up to two additional weeks on their payment by paying a small fee. The fee is between $1 and $3, depending on the area.

If the payment is not made or the extension has not been applied, the app charges a $7 fee. The fee can increase to 25% if the order value is higher.

Zip Pay emails you to pay as soon as possible if the payment is declined. They charge a $5 late fee if it’s not paid in three weeks.

Not paying on time with both can lead to lower spending limits and account restrictions.

Which one is for you

Overall, Zip Pay is easier to use than Klarna. It’s also cost-effective as it doesn’t charge any upfront payment and is more flexible on repayments.

I suggest using Zip Pay if you have to choose between the two. However, the best recommendation is to sign up for both.

Both bring many offers, and you can get heavy discounts using the right service at the right time.

Klarna vs. Zip: Links

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.