Klarna is one of the platforms supporting both in-store and online shopping. It also brings some risks. One of those is your credit score and how it is affected.

Does Klarna affect your credit score, and what should you do about it? All is covered here.

In a nutshell

Klarna does a soft credit when you use its buy now, pay later service (US and Australia). A soft check contains seeing your overall score but not contributing to it.

The app does not do any checks when you create an account. When using Klarna, the app will do a soft check, and if the credit score is already bad, it may decline the order.

However, if you choose Klarna Financing and don’t pay minimum payments on time, Klarna may affect your credit score.

Does Klarna affect credit score

Klarna is a multinational platform, so it works differently in every country.

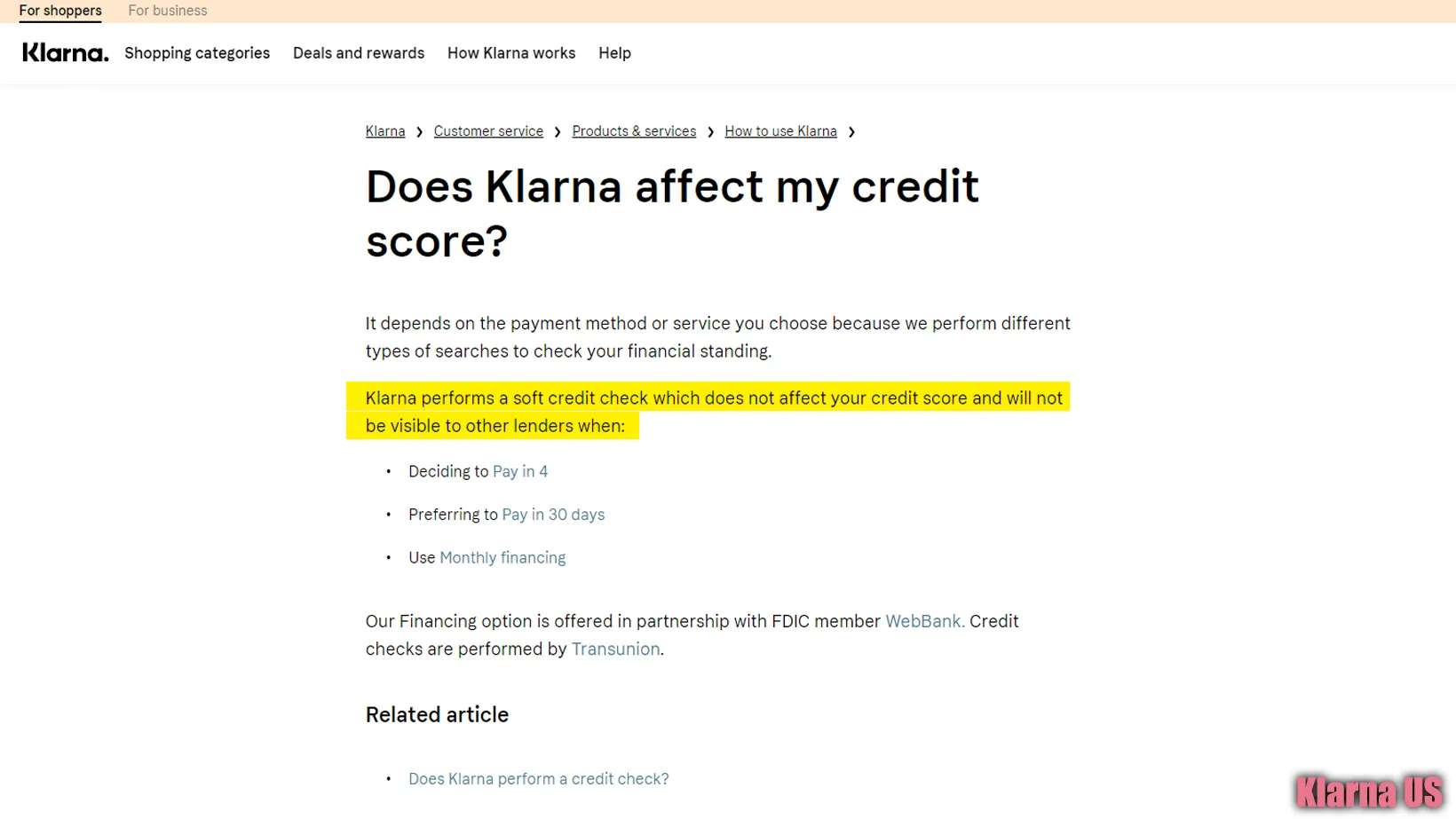

US

Klarna offers multiple services in the US, including:

- Pay in 4 (pay 25% installment every fortnight)

- Pay in 30 days (payback in 30 days)

- Klarna Financing (gives you more time to pay, but comes with up to 30% Annual Percentage Rate)

When you choose any of those services, it does a soft check. Its website suggests that using those services does not affect your credit score.

However, you should know that Klarna Financing is a lending service that charges interest. Where there are interests, there is a chance that your information could be reported.

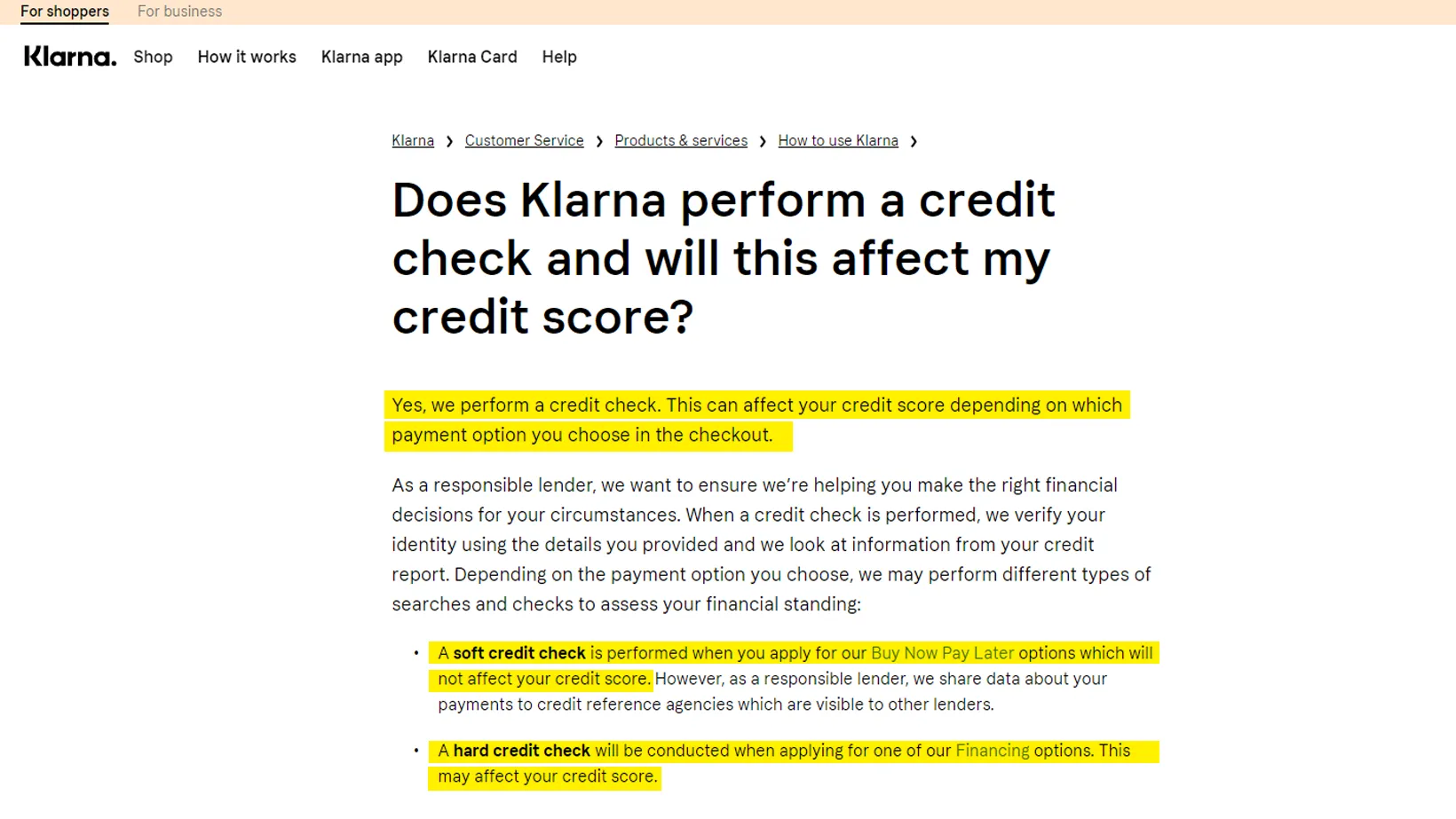

UK

In the UK, Klarna does both soft and hard checks. It also affects your overall score if you don’t pay on time.

As it offers both buy now, pay later and Klarna Financing, it does a soft check when you use the former and a hard check when you use the latter.

The Klarna website shows that the app won’t affect your score, but if you use its buy now, pay later service.

Klarna also says it discloses your Klarna Financing unpaid payments on your report, which may affect other lenders’ decisions about lending you money.

Also, with Klarna Financing, not paying back on time will add interest.

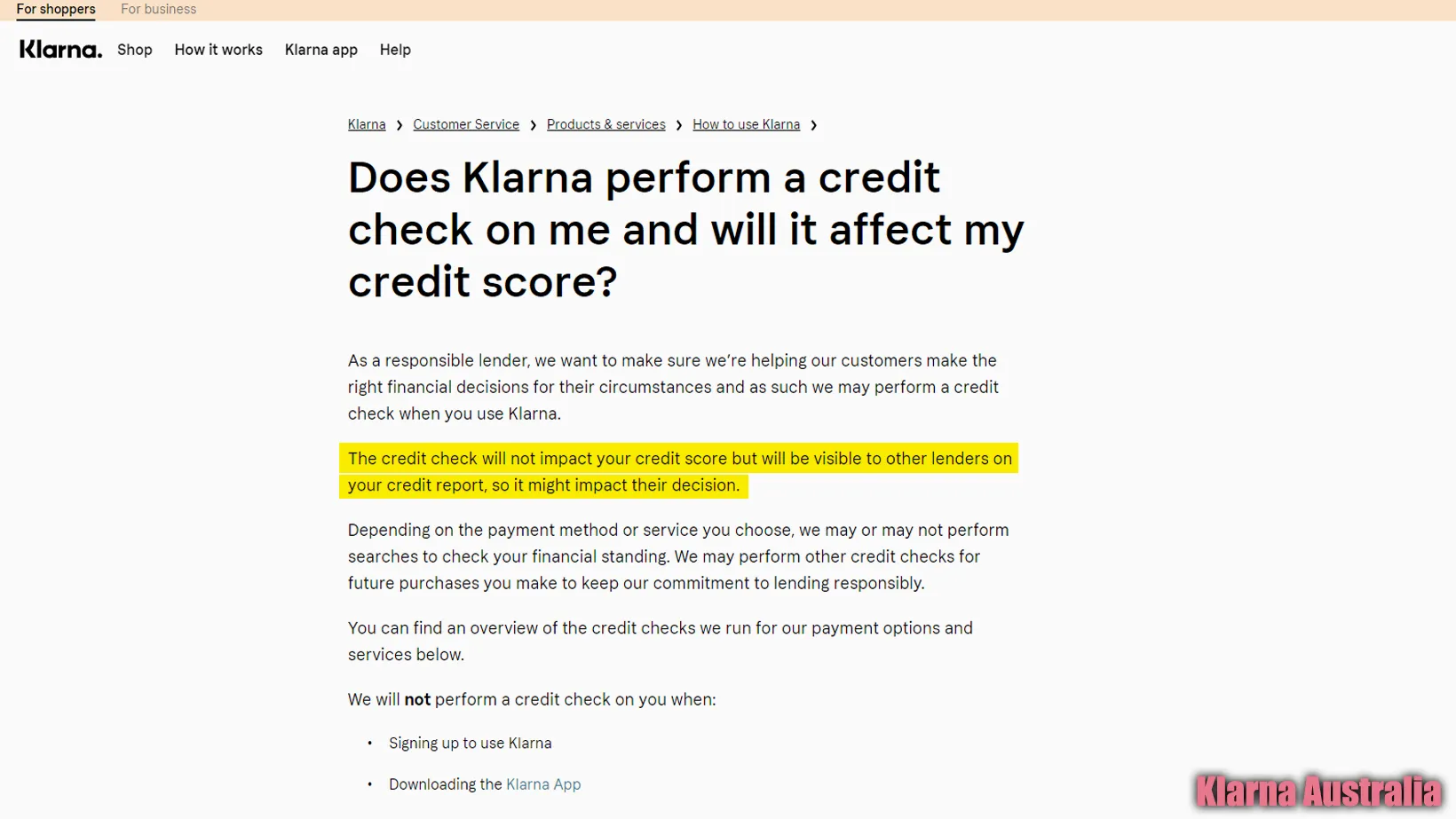

Australia

Klarna only has the Pay in 4 option in Australia, so understanding it is straightforward. Like in other nations, it does a credit check in a few situations:

- When you pay with Klarna for the first time (through the app or website checkout).

- When you use the app after a year.

Klarna says that their checks don’t impact your rating but will be visible on your credit report, which can change others’ decision of loaning.

How Klarna does credit checks

Klarna uses different services in different regions. In the US, they use TransUnion. In the UK, it uses both TransUnion and Experian; in Australia, it uses Illion to do credit checks.

Some lenders also allow you to get free credit reports, but you must sign up and provide identity documents.

What should you do

If you use Klarna, always use its Pay in 4 or Pay in 30 options, as those are the safest choices. The platform does not give you much amount, but it keeps you safe from bad credit.

You should also try the apps that do not do hard checks. This will ensure you never compromise your score for a few hundred dollars.

If you can, you should stop using those apps and use your credit card, which will keep things simple financially.

Conclusion

Klarna is an excellent app with some risks. While using it, you will be able to share your score; however, in most cases, it won’t affect it.

The best recommendation I have for questions like does Klarna affects credit score is to avoid using those apps.

The credit score is a challenging topic, and if you don’t fully understand it, it’s better to stay away.

Madhsudhan Khemchandani has a bachelor’s degree in Software Engineering (Honours). He has been writing articles on apps and software for over five years. He has also made over 200 videos on his YouTube channel. Read more about him on the about page.